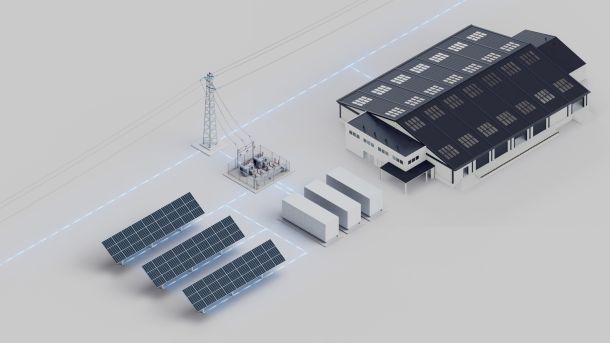

Energy prices are no longer background noise in the energy transition. They have become a defining signal, reshaping where and how distributed energy resources (DERs) are deployed. From rooftop solar to utility-scale batteries, pricing now influences every choice along the value chain. For operators, EPCs and asset managers, understanding these economic signals is critical to building resilient and competitive portfolios.

When Price Becomes the Starting Point for DER Planning

In the past, DER projects were guided primarily by resource potential and policy support. Today, they begin with price. In markets where electricity is affordable and steady, central generation retains its position. But in regions facing volatility and price spikes, decentralized systems offer more control, responsiveness and economic leverage.

System sizing, component selection and dispatch strategies are increasingly shaped by price signals. Especially in volatile markets, projects are built not only for generation, but for flexibility and value capture across multiple revenue streams.

Volatility Drives the Case for Decentralization

Spot Market Fluctuations and Asset Optimization

Price swings in real-time markets can erode returns or unlock hidden opportunities. Operators are forced to rethink how they operate DER assets. Timing becomes everything. Discharging a battery during evening peaks or curtailing output during negative pricing hours can change the financial outcome of a project.

According to ACER’s 2025 market report, the frequency of negative price events in European electricity markets increased by 50% compared to the previous year, particularly driven by high solar and wind penetration in certain regions.

Battery Storage as a Hedging Tool

Storage is no longer just a reliability asset. It has become a core element in financial strategy. Storing energy during low-price periods and selling during peaks helps stabilize cash flow and offset risk. In markets with dynamic pricing or direct wholesale exposure, battery systems are often the difference between success and failure.

Price Signals that Drive Project Viability

Moving Beyond LCOE

While the Levelized Cost of Energy still matters, it no longer tells the full story. In fast-moving markets, short-term and structural price signals determine whether a DER asset will create real value. Projects now compete not just on cost, but on timing, responsiveness and the ability to adapt.

Incentives, Capacity Payments and TOU Tariffs

Financial success increasingly depends on the market mechanisms surrounding a project. Time-of-use pricing, capacity auctions and localized production incentives can have a greater impact than generation efficiency. Developers who understand these levers build stronger, more bankable business cases.

Local Markets, Local Realities

Grid Constraints and Locational Marginal Pricing

In areas with high congestion, grid location can be as important as technology. Locational Marginal Pricing (LMP) exposes DER operators to site-specific price signals. A solar-plus-storage system in a high-LMP zone can outperform a larger project in a low-demand area, purely because of where it sits on the grid.

The European Commission is advancing electricity market reforms to address regional congestion and enhance price stability in both spot and forward markets. Locational signals are expected to play a larger role in asset siting decisions under these reforms.

Navigating Tariff Diversity

Energy tariffs vary widely across utilities and countries. Some regions still offer feed-in tariffs and net metering, while others impose demand charges or export restrictions. Local context matters. What works in one region may fail in another. Templates and copy-paste solutions often fall short.

Real-Time Pricing Requires Smarter Systems

Market-Aware DERMS Algorithms

Modern Distributed Energy Resource Management Systems (DERMS) are now built to forecast and react to price signals. By integrating real-time market data, these systems dispatch assets when prices are favorable and curtail or shift load when prices drop. This market sensitivity turns DERs into economic actors, not just technical assets.

A 2025 analysis by the Joint Research Centre of the European Commission notes that electricity prices in Europe can fluctuate up to 20 times more than other commodities, with intra-day variation exceeding 1,000%. This volatility underscores the need for price-aware forecasting in DERMS platforms.

Load Flexibility and Demand Response

DERMS platforms extend price responsiveness beyond generation. Commercial HVAC, industrial processes and flexible loads are now managed to respond to market fluctuations. This coordination reduces operating costs, improves grid stability and often transforms passive users into revenue-generating participants.

Strategic Lessons for Energy Professionals

Time Your Entry, Not Just Your Tech

Getting the timing wrong can undermine a well-designed project. Operators and EPCs need to follow not just regulatory signals, but the broader price cycles. Understanding when to invest, where to site and how to hedge is as important as the choice of inverter or panel.

Design for Change, Not Just Today

Energy markets will continue to evolve. DER systems must be built with flexibility at their core. Modular hardware, remote configurability and software-defined control are essential. Systems locked into static configurations struggle to keep up with shifting incentives and price structures.

Beyond Capacity

The most successful energy strategies are not those that chase size, but those that maximize agility. Market-ready DER portfolios prioritize interoperability, automation and financial responsiveness. In an environment where prices shift faster than infrastructure can be built, success belongs to those who can move with the market, not just build for it.